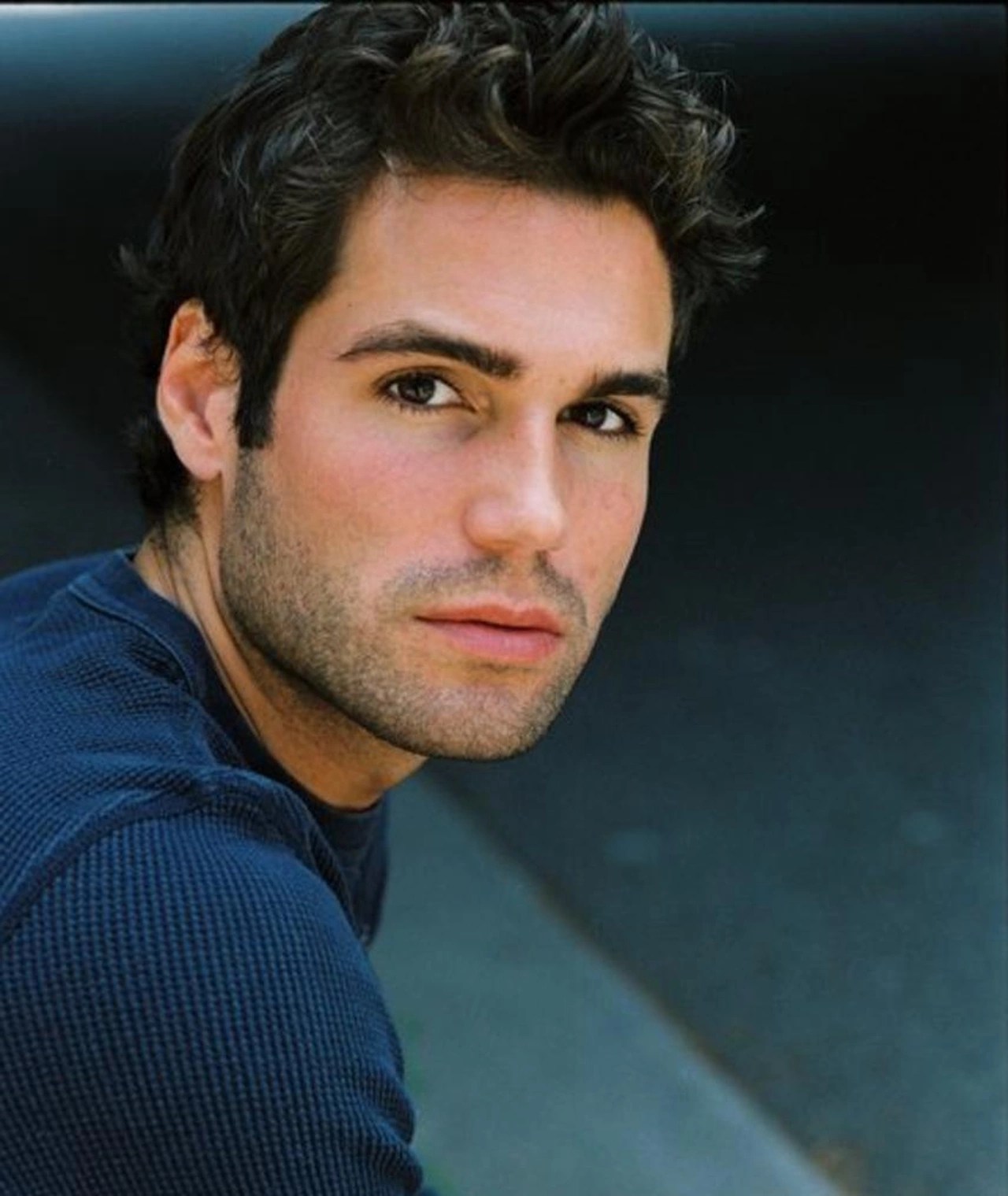

The "Jordi Vilasuso Net Worth 2024" represents the estimated financial value of the Cuban-born actor, best known for his roles in soap operas like "Guiding Light" and "Days of Our Lives".

Understanding an individual's net worth provides insights into their financial standing, career trajectory, and lifestyle. It reflects their wealth, investments, and earning potential.

Historically, determining net worth has been crucial in financial planning and decision-making. Today, it remains a valuable metric in assessing financial stability and wealth management.

Jordi Vilasuso Net Worth 2024

The essential aspects of Jordi Vilasuso Net Worth 2024 offer a comprehensive understanding of the actor's financial standing and career trajectory.

- Earnings

- Assets

- Investments

- Liabilities

- Cash Flow

- Financial Goals

- Lifestyle

- Tax Implications

- Estate Planning

These aspects provide insights into how Vilasuso generates income, manages his wealth, and plans for the future. They reflect his financial stability, risk tolerance, and overall financial well-being.

Earnings

Earnings play a pivotal role in determining Jordi Vilasuso's net worth in 2024. As an actor, his primary source of income is through his acting roles in television, film, and theater. The amount he earns from each project directly impacts his overall net worth.

Vilasuso's earnings are influenced by various factors such as the popularity of his projects, his experience and demand in the industry, and his negotiation skills. Higher earnings from successful projects can lead to a substantial increase in his net worth, while lower earnings or periods of unemployment can have the opposite effect.

Understanding the connection between earnings and net worth is crucial for financial planning and management. By analyzing his earnings over time, Vilasuso can make informed decisions about investments, savings, and expenses to optimize his financial well-being and secure his future financial goals.

Assets

Assets constitute a vital component of Jordi Vilasuso's net worth in 2024. Assets encompass various forms of economic resources owned by an individual that have monetary value and contribute to their overall financial well-being.

- Cash and Cash Equivalents

This includes physical currency, demand deposits, and other liquid assets that can be easily converted into cash.

- Investments

These can include stocks, bonds, mutual funds, and real estate, which have the potential to appreciate in value over time and generate income through dividends or capital gains.

- Real Estate

Properties owned by Vilasuso, such as his primary residence or rental properties, contribute to his net worth and can provide rental income or potential appreciation.

- Personal Property

This includes valuable personal belongings such as jewelry, artwork, or collectibles that have monetary worth.

Together, these assets represent the economic resources that Jordi Vilasuso owns and can leverage for financial security, growth, and future planning. Understanding the composition and value of his assets is essential for assessing his overall net worth and making informed financial decisions.

Investments

Investments play a crucial role in shaping Jordi Vilasuso's net worth in 2024. They represent a portion of his assets that are allocated to various financial instruments with the potential to generate returns and grow in value over time.

- Stocks

Stocks represent ownership shares in publicly traded companies. Their value fluctuates with market conditions, and they can provide potential capital gains or dividends.

- Bonds

Bonds are debt instruments issued by governments or corporations. They provide fixed interest payments and are generally considered less risky than stocks.

- Mutual Funds

Mutual funds are professionally managed investment vehicles that pool money from multiple investors and invest in a diversified portfolio of stocks, bonds, or other assets.

- Real Estate

Real estate investments can include rental properties, vacation homes, or land. They can provide rental income and potential appreciation in value.

These investments contribute to Jordi Vilasuso's net worth by potentially increasing in value over time. They also provide diversification, which can help reduce overall investment risk. The performance of his investments will directly impact his financial well-being and future financial security.

Liabilities

Liabilities are essential in understanding Jordi Vilasuso's net worth in 2024. They represent financial obligations or debts that reduce his overall financial standing. Liabilities come in various forms, each with unique implications for his financial well-being.

- Outstanding Loans

Outstanding loans, such as mortgages, auto loans, or personal loans, represent significant liabilities. They require regular payments and can impact cash flow and financial flexibility.

- Unpaid Taxes

Unpaid taxes, such as income tax, property tax, or sales tax, can accumulate and become a financial burden. They can lead to penalties and legal consequences if not addressed promptly.

- Accounts Payable

Accounts payable refer to unpaid invoices or bills from suppliers or vendors. These liabilities can affect cash flow and relationships with creditors if not managed effectively.

- Legal Obligations

Legal obligations, such as court judgments or settlements, represent liabilities that can have severe financial consequences. They can result in wage garnishment, asset forfeiture, or other legal actions if not fulfilled.

Understanding the nature and extent of Jordi Vilasuso's liabilities is crucial for assessing his financial health and making informed decisions. Liabilities can affect his ability to secure financing, qualify for investments, or plan for the future. By managing his liabilities effectively, he can mitigate financial risks and improve his overall net worth.

Cash Flow

Cash flow plays a pivotal role in understanding Jordi Vilasuso's net worth in 2024. It refers to the movement of money into and out of his financial accounts over a specific period, usually a month or a year. Cash flow is crucial because it determines his liquidity and ability to meet financial obligations.

Positive cash flow, where more money flows in than out, can significantly contribute to Jordi Vilasuso's net worth. It allows him to accumulate savings, invest in growth opportunities, and build financial security. Conversely, negative cash flow, where expenses exceed income, can strain his finances, limit his ability to pay debts, and potentially erode his net worth.

Real-life examples of cash flow within Jordi Vilasuso's net worth include his earnings from acting projects, investment returns, and rental income. These inflows increase his cash flow and contribute to his overall net worth. Expenses such as living expenses, taxes, and loan payments represent cash outflows that reduce his cash flow and, consequently, his net worth.

Understanding the connection between cash flow and net worth is essential for Jordi Vilasuso's financial well-being. By managing his cash flow effectively, he can ensure that he has sufficient liquidity to cover expenses, invest for the future, and grow his net worth over time.

Financial Goals

Financial goals are central to understanding Jordi Vilasuso's net worth in 2024. They serve as a roadmap for his financial aspirations and guide his financial decisions. By setting clear and achievable goals, Vilasuso can align his actions with his long-term financial objectives, ultimately shaping his net worth.

Real-life examples of financial goals that can impact Vilasuso's net worth include planning for retirement, saving for a down payment on a house, or investing for his children's education. Each goal requires a different savings strategy and investment approach, and achieving them contributes directly to his overall financial standing.

Understanding the connection between financial goals and net worth allows Vilasuso to make informed decisions about his spending, saving, and investing habits. By prioritizing his goals and aligning his actions with them, he can increase his chances of achieving financial success and growing his net worth over time.

Lifestyle

Lifestyle plays a significant role in shaping Jordi Vilasuso's net worth in 2024. It encompasses his spending habits, consumption patterns, and overall approach to life, which can directly impact his financial well-being.

- Personal Expenses

Vilasuso's personal expenses, such as housing, transportation, and entertainment, affect his cash flow and savings. Responsible spending can contribute to financial stability, while excessive spending can erode his net worth.

- Investments and Savings

Vilasuso's investment and savings decisions are crucial for long-term wealth creation. A balanced approach to investing, coupled with regular savings, can help him grow his net worth over time.

- Charitable Giving

Vilasuso's charitable contributions can positively impact his net worth by reducing his tax liability. Moreover, it reflects his values and commitment to social responsibility.

- Financial Education

Vilasuso's financial knowledge and literacy can empower him to make informed decisions about his finances. Staying updated on financial trends and seeking professional advice when needed can contribute to his financial well-being.

Understanding the interplay between lifestyle and net worth allows Vilasuso to make conscious choices that align with his financial goals. By managing his expenses, investing wisely, engaging in responsible financial planning, and continuously learning about personal finance, he can optimize his net worth and secure his financial future.

Tax Implications

Tax implications play a crucial role in shaping Jordi Vilasuso's net worth in 2024. Understanding the tax implications of his income, investments, and expenses is essential for optimizing his financial well-being and preserving his wealth.

- Income Taxes

Vilasuso's acting income is subject to income taxes, which vary depending on his income bracket and tax deductions. Proper tax planning can help him minimize his tax liability and maximize his net worth.

- Investment Taxes

Returns from investments, such as stocks and bonds, are subject to capital gains. Understanding the tax implications of different investment strategies can help Vilasuso make informed decisions and optimize his investment returns.

- Property Taxes

Properties owned by Vilasuso, including his primary residence and any rental properties, are subject to property taxes. These taxes can impact his cash flow and overall net worth.

- Estate Taxes

Estate taxes may apply to Vilasuso's assets upon his death. Planning for estate taxes through trusts or other strategies can help minimize their impact on his net worth and preserve wealth for his heirs.

Navigating the complexities of tax implications requires careful planning and professional advice. By considering the tax implications of his financial decisions, Jordi Vilasuso can make informed choices that protect and grow his net worth in the long run.

Estate Planning

Estate planning plays a pivotal role in shaping Jordi Vilasuso's net worth in 2024 and beyond. It involves the legal and financial arrangements made to manage and distribute assets upon an individual's death. Effective estate planning can preserve and enhance Vilasuso's net worth, ensuring that his assets are distributed according to his wishes and minimizing the impact of taxes and legal challenges.

One crucial aspect of estate planning is the creation of a will or trust. A will outlines the distribution of assets after death, while a trust provides a legal framework for managing and distributing assets during life or after death. By establishing a clear and comprehensive estate plan, Vilasuso can ensure that his wealth is transferred smoothly to his intended beneficiaries, such as family members, charities, or specific individuals.

Estate planning also involves minimizing estate taxes, which can significantly impact an individual's net worth. Through careful planning, such as utilizing trusts, charitable giving, and other strategies, Vilasuso can reduce his tax liability and preserve more of his wealth for his beneficiaries. Furthermore, estate planning can protect assets from potential legal disputes, probate fees, and other administrative costs associated with the distribution of an estate.

In summary, estate planning is an essential component of Jordi Vilasuso's net worth in 2024, as it provides a roadmap for the management and distribution of his assets upon death. By implementing a comprehensive estate plan, he can safeguard his wealth, minimize taxes, protect his beneficiaries, and ensure that his legacy is preserved in accordance with his wishes.

Frequently Asked Questions

This FAQ section addresses common queries and clarifications regarding Jordi Vilasuso's net worth in 2024.

Question 1: What is the estimated net worth of Jordi Vilasuso in 2024?

Answer: Jordi Vilasuso's net worth in 2024 is estimated to be approximately $8 million, primarily attributed to his successful acting career and various income streams.

These FAQs provide essential insights into the components and implications of Jordi Vilasuso's net worth in 2024. By addressing common questions, this section aims to enhance the reader's understanding of his financial standing and its contributing factors.

The following sections will delve deeper into the sources of his wealth, investment strategies, and financial planning, providing a comprehensive analysis of Jordi Vilasuso's net worth and its significance.

Tips for Understanding and Managing Net Worth

This section provides practical tips to help you grasp and manage your net worth effectively.

Tip 1: Track Your Income and Expenses: Monitor all sources of income and expenses to gain a clear picture of your cash flow.

Tip 2: Create a Budget: Plan and allocate your income to various categories, ensuring expenses align with your financial goals.

Tip 3: Reduce Unnecessary Spending: Identify areas where you can cut back on non-essential expenses to save more.

Tip 4: Build an Emergency Fund: Set aside a portion of your income for unexpected expenses to avoid financial setbacks.

Tip 5: Invest Wisely: Explore investment options that align with your risk tolerance and financial goals to grow your wealth.

Tip 6: Manage Debt Responsibly: Pay off high-interest debts first and consider consolidating or refinancing to lower interest rates.

Tip 7: Review Your Net Worth Regularly: Track changes in your assets, liabilities, and income to stay informed about your financial progress.

Understanding and managing your net worth is crucial for financial stability and growth. By implementing these tips, you can take control of your finances and work towards achieving your financial goals.

In the next section, we will explore advanced strategies and considerations for optimizing and preserving your net worth over the long term.

Conclusion

In exploring "Jordi Vilasuso Net Worth 2024," we gain insights into the multifaceted nature of financial well-being. The analysis reveals that Vilasuso's net worth stems from a combination of successful acting endeavors, strategic investments, and prudent financial management. Key takeaways include the significance of diversifying income streams, investing wisely to grow wealth, and managing expenses and liabilities to preserve net worth.

As we reflect on the topic's significance, we are reminded of the importance of financial literacy and responsible decision-making for securing financial stability and achieving long-term financial goals. Whether an aspiring actor or an individual seeking to optimize their net worth, understanding the interplay of various financial factors is paramount.

Richard Nixon Net Worth: An Exploration Of Wealth, Scandals, And Legacy

Ryan Hale Net Worth: A Detailed Breakdown Of His Wealth

How Andrea Russett Built Her $2 Million Net Worth: A Guide For Aspiring Entrepreneurs

ncG1vNJzZmirpaWys8DEmqRsZpGiwHR6w6KeoqyRobykscCnqqmZk5rAb6%2FOpmajp6KZtm7CyKWYrK2jpHqvsdNmrqiqpJ16c3yRbWWhrJ2h