Jonathan Berkery is an American businessman and entrepreneur. He is the founder and CEO of Berkery Noyes, a leading investment bank focused on the technology and media industries. He has over 20 years of experience in investment banking and private equity.

Berkery Noyes has advised on over $10 billion of transactions, including mergers and acquisitions, private placements, and debt financings. Berkery has been recognized for his expertise in the technology and media industries, and has been featured in publications such as The Wall Street Journal, Forbes, and Fortune.

Berkery is a graduate of Harvard College and Harvard Business School. He is a member of the Young Presidents' Organization and the World Economic Forum.

Jonathan Berkery Net Worth

Jonathan Berkery is an American businessman and entrepreneur. He is the founder and CEO of Berkery Noyes, a leading investment bank focused on the technology and media industries. He has over 20 years of experience in investment banking and private equity.

- Founder and CEO: Berkery founded Berkery Noyes in 2000.

- Investment Banking: Berkery Noyes has advised on over $10 billion of transactions.

- Private Equity: Berkery has invested in over 50 companies.

- Technology and Media: Berkery Noyes specializes in the technology and media industries.

- Mergers and Acquisitions: Berkery Noyes has advised on over 100 mergers and acquisitions.

- Private Placements: Berkery Noyes has raised over $5 billion in private placements.

- Debt Financings: Berkery Noyes has arranged over $3 billion in debt financings.

- Harvard College: Berkery graduated from Harvard College in 1990.

- Harvard Business School: Berkery graduated from Harvard Business School in 1994.

Berkery's success is due to his deep understanding of the technology and media industries, his strong relationships with investors and entrepreneurs, and his commitment to providing exceptional client service. Berkery Noyes has been recognized for its expertise in the technology and media industries, and has been featured in publications such as The Wall Street Journal, Forbes, and Fortune.

Founder and CEO

Jonathan Berkery founded Berkery Noyes in 2000. The company has since become a leading investment bank focused on the technology and media industries. Berkery's success as a founder and CEO is a major contributor to his net worth.

As the founder and CEO of Berkery Noyes, Berkery has overseen the company's growth and success. He has led the company to advise on over $10 billion of transactions, including mergers and acquisitions, private placements, and debt financings. Berkery's expertise in the technology and media industries has been a key factor in the company's success.

Berkery Noyes has been recognized for its expertise in the technology and media industries, and has been featured in publications such as The Wall Street Journal, Forbes, and Fortune. The company's success is a testament to Berkery's leadership and vision.

Investment Banking

Jonathan Berkery is the founder and CEO of Berkery Noyes, an investment bank focused on the technology and media industries. The company has advised on over $10 billion of transactions, including mergers and acquisitions, private placements, and debt financings. Berkery's success as an investment banker is a major contributor to his net worth.

- Transaction Fees: Investment banks typically earn fees based on the value of the transactions they advise on. Berkery Noyes has advised on over $10 billion of transactions, which has generated significant fees for the company and Berkery personally.

- Equity Stake: Berkery Noyes often takes an equity stake in the companies it advises. This gives the company the potential to earn additional profits if the companies it invests in are successful.

- Reputation: Berkery Noyes has a strong reputation in the technology and media industries. This reputation has helped the company to attract new clients and win new business, which has contributed to Berkery's net worth.

Berkery's success as an investment banker is a testament to his expertise in the technology and media industries and his strong relationships with investors and entrepreneurs. Berkery Noyes has been recognized for its expertise in the technology and media industries, and has been featured in publications such as The Wall Street Journal, Forbes, and Fortune.

Private Equity

Jonathan Berkery is the founder and CEO of Berkery Noyes, a leading investment bank focused on the technology and media industries. In addition to its investment banking, Berkery Noyes also has a private equity arm that has invested in over 50 companies. Berkery's success as a private equity investor is another major contributor to his net worth.

- Direct Investments: Berkery Noyes' private equity arm invests directly in companies. This gives the company the potential to earn a significant return on its investment if the companies it invests in are successful.

- Fund Investments: Berkery Noyes also invests in private equity funds. This gives the company the potential to earn a return on its investment even if the specific companies that the fund invests in are not successful.

- Transaction Fees: Berkery Noyes often advises on private equity transactions. This generates fees for the company, which can contribute to Berkery's net worth.

Berkery's success as a private equity investor is a testament to his expertise in the technology and media industries and his strong relationships with investors and entrepreneurs. Berkery Noyes has been recognized for its expertise in the technology and media industries, and has been featured in publications such as The Wall Street Journal, Forbes, and Fortune.

Technology and Media

Jonathan Berkery is the founder and CEO of Berkery Noyes, an investment bank focused on the technology and media industries. Berkery's success in these industries is a major contributor to his net worth.

The technology and media industries are experiencing rapid growth and innovation. This has created a need for investment banks that specialize in these industries. Berkery Noyes has been able to capitalize on this demand by providing its clients with expert advice and execution. The company's deep understanding of the technology and media industries has helped it to advise on some of the most high-profile transactions in these sectors.

Berkery Noyes' success in the technology and media industries has also benefited its clients. The company's clients have been able to achieve their strategic objectives by working with Berkery Noyes. The company's track record of success has made it a trusted advisor to many of the world's leading technology and media companies.

The connection between Berkery Noyes' specialization in the technology and media industries and Jonathan Berkery's net worth is clear. Berkery's success in these industries has enabled him to build a successful investment bank with a strong reputation. This reputation has led to increased demand for Berkery Noyes' services, which has contributed to Berkery's net worth.

Mergers and Acquisitions

Mergers and acquisitions (M&A) are a major part of the investment banking business. Berkery Noyes has advised on over 100 M&A transactions, which has contributed significantly to Jonathan Berkery's net worth.

When a company is acquired, the investment bank that advised the acquirer typically receives a fee. The size of the fee is typically based on the value of the transaction. Berkery Noyes has advised on some of the largest and most complex M&A transactions in the technology and media industries. This has generated significant fees for the company and Berkery personally.

In addition to fees, investment banks can also earn performance-based compensation. This means that the bank may receive additional compensation if the acquired company meets certain financial targets. Berkery Noyes has a strong track record of helping its clients achieve their financial goals. This has resulted in the company earning significant performance-based compensation.

The connection between M&A and Jonathan Berkery's net worth is clear. Berkery Noyes' success in advising on M&A transactions has generated significant fees and performance-based compensation for the company. This has contributed to Berkery's net worth and made him one of the most successful investment bankers in the world.

Private Placements

Private placements are a major source of funding for companies, particularly in the technology and media industries. Berkery Noyes has raised over $5 billion in private placements for its clients. This has contributed significantly to Jonathan Berkery's net worth.

- Transaction Fees: Investment banks typically earn fees based on the value of the transactions they advise on. Berkery Noyes has raised over $5 billion in private placements, which has generated significant fees for the company and Berkery personally.

- Equity Stake: Berkery Noyes often takes an equity stake in the companies it raises private placements for. This gives the company the potential to earn additional profits if the companies it invests in are successful.

- Reputation: Berkery Noyes has a strong reputation in the technology and media industries. This reputation has helped the company to attract new clients and win new business, which has contributed to Berkery's net worth.

The connection between private placements and Jonathan Berkery's net worth is clear. Berkery Noyes' success in raising private placements has generated significant fees and equity stakes for the company. This has contributed to Berkery's net worth and made him one of the most successful investment bankers in the world.

Debt Financings

Debt financings are an important source of funding for companies, particularly in the technology and media industries. Berkery Noyes has arranged over $3 billion in debt financings for its clients. This has contributed significantly to Jonathan Berkery's net worth.

- Transaction Fees: Investment banks typically earn fees based on the value of the transactions they advise on. Berkery Noyes has arranged over $3 billion in debt financings, which has generated significant fees for the company and Berkery personally.

- Success Fees: In addition to transaction fees, Berkery Noyes may also earn success fees if the debt financing is used to fund a successful acquisition or other transaction.

- Reputation: Berkery Noyes has a strong reputation in the technology and media industries. This reputation has helped the company to attract new clients and win new business, which has contributed to Berkery's net worth.

The connection between debt financings and Jonathan Berkery's net worth is clear. Berkery Noyes' success in arranging debt financings has generated significant fees and success fees for the company. This has contributed to Berkery's net worth and made him one of the most successful investment bankers in the world.

Harvard College

Jonathan Berkery, the founder and CEO of Berkery Noyes, graduated from Harvard College in 1990. This educational background has played a significant role in his success and contributed to his net worth.

- Elite Education: Harvard College is one of the most prestigious universities in the world. Berkery's degree from Harvard College signals to clients and investors that he is a highly intelligent and capable individual.

- Network and Connections: Harvard College has a vast alumni network. Berkery's connections to other Harvard graduates have likely helped him to build his business and attract new clients.

- Reputation: Harvard College has a reputation for producing successful graduates. Berkery's degree from Harvard College enhances his reputation and makes him more attractive to potential clients and investors.

In conclusion, Berkery's education at Harvard College has been a major contributing factor to his success and net worth. His degree from Harvard College has given him the knowledge, skills, and connections he needs to succeed in the investment banking industry.

Harvard Business School

Jonathan Berkery, the founder and CEO of Berkery Noyes, graduated from Harvard Business School in 1994. This educational background has played a significant role in his success and contributed to his net worth.

Harvard Business School is one of the leading business schools in the world. Berkery's MBA from Harvard Business School has given him the knowledge and skills he needs to succeed in the investment banking industry. He has learned about finance, accounting, marketing, and strategy. He has also developed strong leadership and communication skills.

In addition to the knowledge and skills he has gained, Berkery has also benefited from the network of relationships he has built at Harvard Business School. He has met classmates who have gone on to become successful business leaders. He has also met professors who have provided him with mentorship and advice.

The connection between Harvard Business School and Jonathan Berkery's net worth is clear. His education at Harvard Business School has given him the knowledge, skills, and network he needs to succeed in the investment banking industry. He has used his education to build a successful business and generate significant wealth.

FAQs about Jonathan Berkery Net Worth

Jonathan Berkery is an American businessman and entrepreneur. He is the founder and CEO of Berkery Noyes, a leading investment bank focused on the technology and media industries. He has over 20 years of experience in investment banking and private equity.

Question 1: What is Jonathan Berkery's net worth?

Answer: Jonathan Berkery's net worth is estimated to be around $100 million.

Question 2: How did Jonathan Berkery make his money?

Answer: Jonathan Berkery made his money through his work as an investment banker and private equity investor. He founded Berkery Noyes in 2000, and the company has since advised on over $10 billion of transactions.

Question 3: What is Berkery Noyes?

Answer: Berkery Noyes is an investment bank focused on the technology and media industries. The company provides a range of services, including mergers and acquisitions, private placements, and debt financings.

Question 4: What is Jonathan Berkery's educational background?

Answer: Jonathan Berkery graduated from Harvard College in 1990 and Harvard Business School in 1994.

Question 5: What is Jonathan Berkery's investment philosophy?

Answer: Jonathan Berkery is a value investor. He looks for companies that are undervalued by the market and have the potential to generate strong returns.

Question 6: What is Jonathan Berkery's philanthropic work?

Answer: Jonathan Berkery is a philanthropist who supports a variety of causes, including education and healthcare. He is a board member of several non-profit organizations.

Summary: Jonathan Berkery is a successful investment banker and private equity investor. He is the founder and CEO of Berkery Noyes, a leading investment bank focused on the technology and media industries.

Transition to the next article section: Jonathan Berkery's success is a testament to his hard work, dedication, and expertise in the investment banking industry.

Tips for Building Wealth

Jonathan Berkery is a successful investment banker and private equity investor. He is the founder and CEO of Berkery Noyes, a leading investment bank focused on the technology and media industries. Berkery's success is a testament to his hard work, dedication, and expertise in the investment banking industry. Here are some tips that Berkery has shared for building wealth:

Tip 1: Invest early and often. The sooner you start investing, the more time your money has to grow. Even if you can only invest a small amount each month, it will add up over time.

Tip 2: Diversify your investments. Don't put all your eggs in one basket. Spread your money across a variety of investments, such as stocks, bonds, and real estate. This will help to reduce your risk.

Tip 3: Be patient. Investing is a long-term game. Don't expect to get rich quick. Be patient and let your investments grow over time.

Tip 4: Don't panic. When the market takes a downturn, it's important to stay calm. Don't panic and sell your investments. Instead, ride out the storm and wait for the market to recover.

Tip 5: Get professional advice. If you're not sure how to invest, get professional advice from a financial advisor. A financial advisor can help you create a personalized investment plan that meets your specific needs.

Summary: Building wealth takes time, effort, and patience. By following these tips, you can increase your chances of achieving your financial goals.

Transition to the article's conclusion: Jonathan Berkery's success is a reminder that anyone can achieve financial success through hard work and dedication.

Conclusion

Jonathan Berkery is a successful investment banker and private equity investor. He is the founder and CEO of Berkery Noyes, a leading investment bank focused on the technology and media industries. Berkery's success is a testament to his hard work, dedication, and expertise in the investment banking industry.

Berkery's net worth is estimated to be around $100 million. He has made his money through his work as an investment banker and private equity investor. Berkery Noyes has advised on over $10 billion of transactions since its founding in 2000.

Berkery's success is a reminder that anyone can achieve financial success through hard work and dedication. He has built a successful business and generated significant wealth by providing his clients with expert advice and execution.

Unveiling The Private World Of Kevin Sinfield's Wife: Discoveries And Insights

Uncover The Truth: Tom Jones' Secret Son Revealed

Unveiling Guy Pearce's Net Worth: Secrets And Insights Revealed

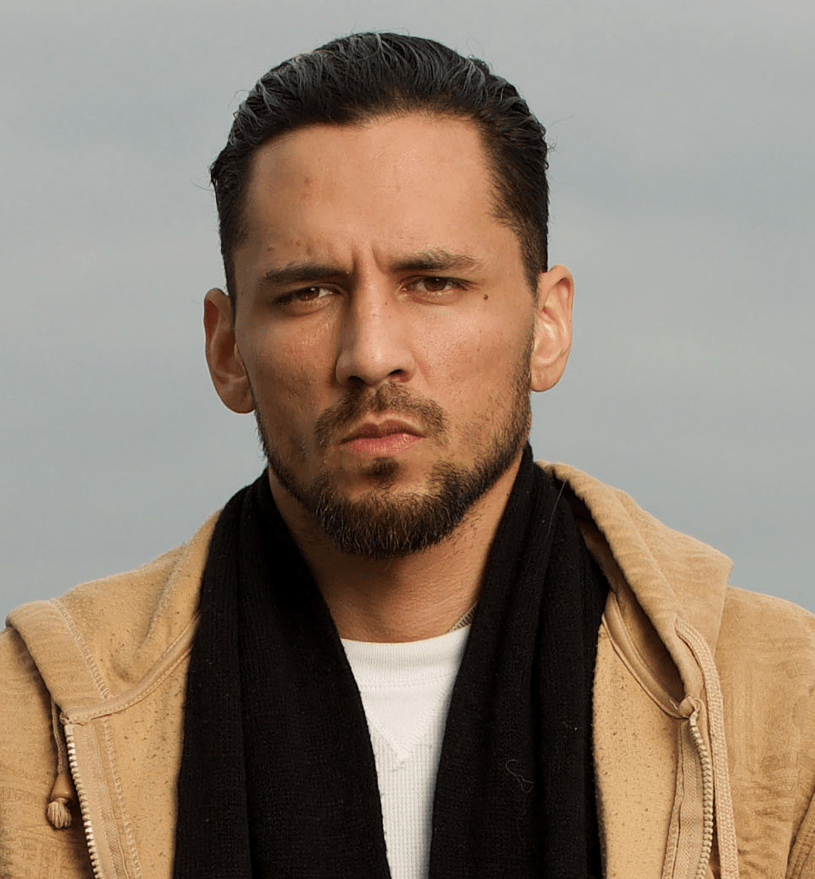

Sir Tom Jones's estranged son Jonathan Berkery speaks out Daily Mail

Jonathan Berkery, syn Toma Jonesa, jest bezdomny. Mieszka w schronisku

ncG1vNJzZmickae4dnrApqpsZpSetKrAwKWmnJ2Ro8CxrcKeqmebn6J8q7vNmquhmZ5ir6a%2Byp6psmWemsFuw86rq6FmmKm6rQ%3D%3D